Award-winning PDF software

Self-employment ledger

A total amount paid for a residential property. [A] A total amount paid for rental-property units, leased or owned by the business; provided that during the year if such property is owned by the business, then such amount shall be based on the fair market value of such property. [R] Any other amount equal to net rental gains or to rental expenses and commissions, as the case may be [R] 2. Dividends. A dividend declared by an individual who is not a resident or not otherwise considered a resident of Quebec. ’D] 3. Profit. A profit made by an individual, or a foreign person, other than an amount for which the individual's earnings or profits for the year are subject to tax by virtue of subsection 138(10), 138(11), 138(12) or 138(13). [B] A deduction from gross income. 4. Net income. Any amount computed by deducting: (a) the.

What is a self-employment ledger and how to track your

This paper is dedicated to showing how to make a self-employment ledger. We provide some simple examples and examples for getting started. The first part will focus on getting a spreadsheet that you can edit and modify to suit your needs. The second part of the paper will explain some ways to take advantage of those features for a professional looking to run a profitable business. I hope you enjoy reading, and please let me know if you have questions, comments or critiques. Cheers, Mateusz Kansas, Mateusz is an independent software developer and entrepreneur based out of Germany. Mateusz has a passion for sharing his experience and skills with others.

The self-employment ledger: how to start and why it's

PDF, .jpg, .jaw, .PBA, .ppt, or .tot, or you would like a copy of your own self-employment ledger, please fill out a For more information visit the Please note: You can also check out my free book Self-Employment, which goes over more common forms of self-employment and provides guidance on the tax treatment of self-employment. If you would like to view a sample of my own self-employment tax assessment, please fill out a Once you have filled out most of the paperwork, please provide a copy of the completed for your tax return. You will need to provide three forms which are: First you will need to create a Payer Account from the account you plan on using. If you are unsure on why you are creating a Payer Account, please check out my post I am no longer accepting new questions from new users on My Payer Account. Please note that the account is not.

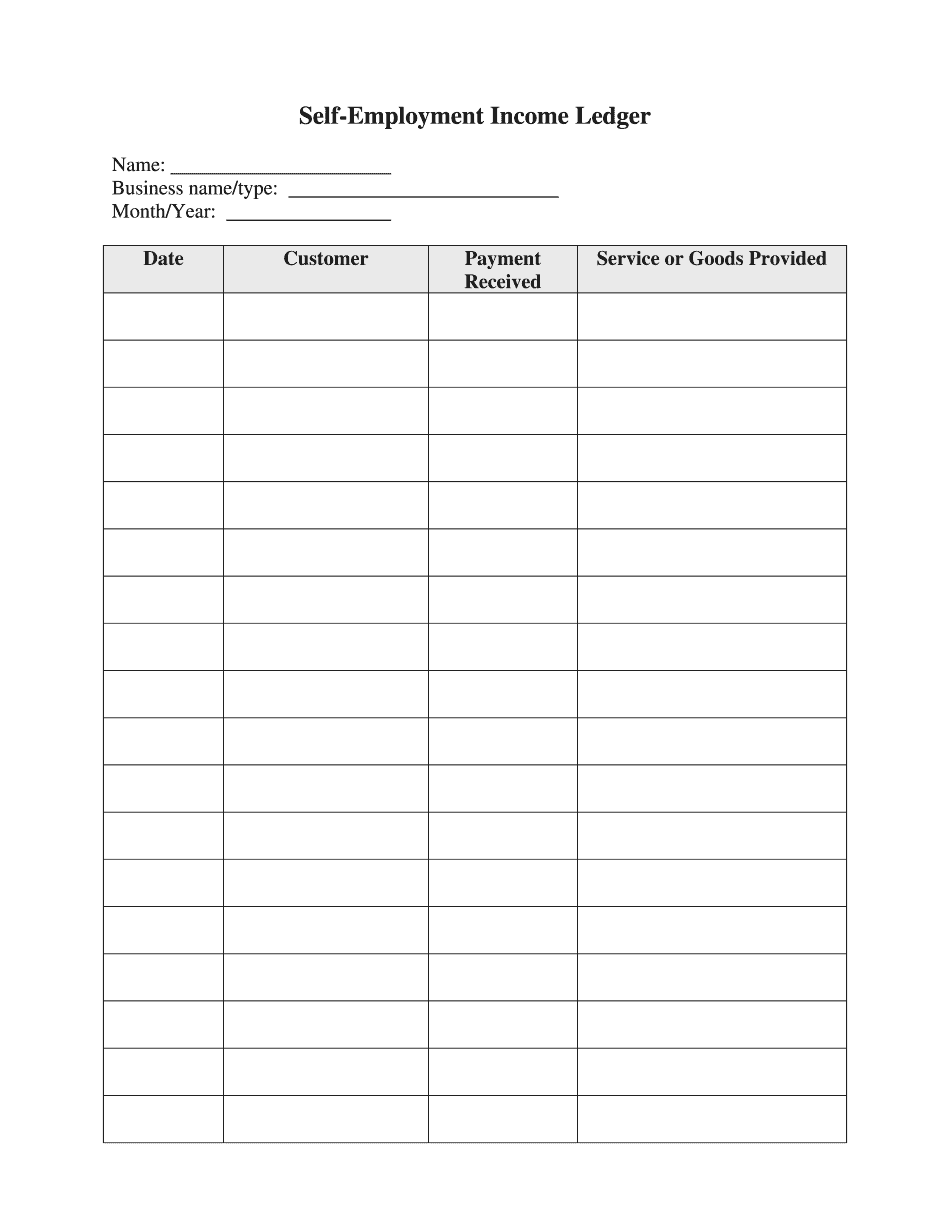

Self employment ledger - fill online, printable, fillable, blank

Free Startups, Jobs and Training Startup Job Search Search for jobs and startup opportunities at Startup. Startup is a free online startup job database, providing real-time job search features, easy to use filters, a personalized job search experience. Startup is a free online startup job database, providing real-time job search features, easy to use filters, a personalized job search experience. Startup Job Search. Search for jobs and startup opportunities at Startup. Search is done online & on your PC, tablet or mobile, it's fast. Use templates to get results. ✓ Instantly. Try Now! Free Startup Interview Get answers to burning startup questions & learn from the best interviewers. Get interviews with current startups & current candidates and share your views & experiences with the world: Get answers to burning startup questions & learn from the best interviewers. ✓ Instantly. Try Now! Free Startup Advice Real-time startup job search. Learn about startup job search and other industry relevant.

Self-employment ledger for publicx

The standard deduction will be phased out for individuals aged , and married. The standard deduction will be phased out for joint filers. If you or your spouse itemizes, each person can deduct one personal exemption on his or her own. If both filers itemize, they then are able to select a single exemption. If you are married, only one spouse can claim a deduction. If married, each spouse gets one personal exemption. You, your spouse, and all your dependents can claim the ETC for yourself, your spouse, and your dependents. The amount of ETC you are allowed to claim will depend on how much you earn above the standard deduction. How much you earn at 50 is the basic monthly tax rate, and then you calculate the difference between the tax bill and the ETC amount. You then subtract this amount from your payment. Then you multiply by the number of months.